What Is Fyers Account? Understanding India’s Top Stockbroker, You’re looking to start investing in stocks but don’t know where to begin. All the brokerages out there can get confusing fast. But you’ve heard good things about Fyers and are wondering – what is a Fyers account? As one of India’s top discount brokers, Fyers offers a ton of features for both beginner and advanced traders. Opening an account only takes a few minutes and you can be up and running in no time. In this article, we’ll break down everything you need to know about Fyers – the account types, fees, platforms, and more. We’ll explain all the nitty gritty details in simple terms so you can decide if a Fyers account is right for your investing needs. Whether you’re just starting out or are an active trader, you’ll learn all about how Fyers works and the tools they provide Indian traders. Let’s dive in and demystify Fyers accounts!

What Is Fyers Account? Understanding India’s Top Stockbroker

What Is Fyers? An Overview of India’s Leading Stockbroker

So, what exactly is Fyers? Fyers is India’s fastest growing brokerage firm that provides online trading services in stocks, commodities and currency derivatives. Founded in 2015, Fyers has quickly become a leader in the Indian brokerage industry.

A Modern, Tech-Driven Broker

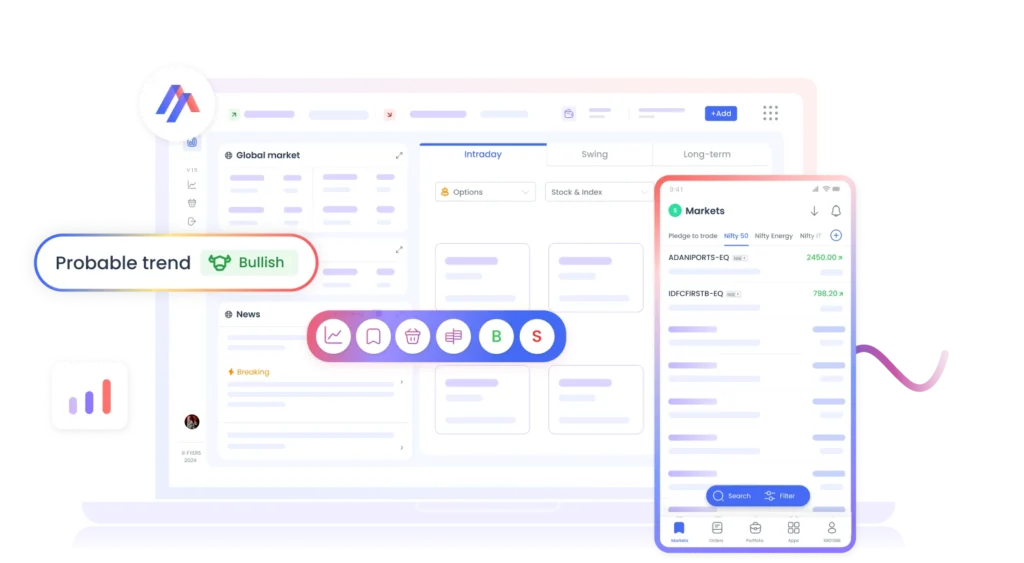

Fyers was built as a tech-first brokerage, focusing on providing fast, reliable and cutting-edge trading platforms for Indian investors. They offer web, desktop and mobile apps with real-time market data, charts, alerts and more. Fyers is also integrated with India’s top exchanges like NSE, BSE, MCX and NCDEX.

Low Brokerage, Zero Account Opening Fees

Fyers aims to make investing accessible for all Indians. They charge ultra-low brokerage fees starting at just ₹20 per trade. Even better, opening a Fyers account is 100% free – no account opening charges or annual maintenance fees. They make money through brokerage on your trades, so they’re incentivized to provide the best service and support.

Robust Research and Education

Fyers provides helpful resources for new and experienced investors. They offer in-depth research reports, news alerts, learning courses and more. Fyers’ education platform, Fyers Learn, includes video courses and blogs to help you become a smarter investor.

Overall, Fyers combines innovative technology with a dedication to low costs and investor education. If you’re looking for an affordable, full-service broker in India, Fyers is an excellent choice. Open your free Fyers account today and start investing with one of India’s top stockbrokers.

Key Features and Benefits of a Fyers Account

Low Brokerage

With Fyers, you’ll pay some of the lowest brokerage fees in India, starting at just ₹20 per trade. This means more of your money stays in your pocket instead of going to fees. Whether you’re a casual investor or trade frequently, the low costs will add up to big savings over time.

Robust Trading Platform

Fyers offers a modern, intuitive web trading platform as well as mobile apps for Android and iOS. You’ll have access to charts, alerts, research, and the ability to place market, limit and stop-loss orders. The platform is stable and high performance, able to handle the demands of active traders.

Personalized Support

As an account holder, you’ll receive dedicated support from knowledgeable representatives. Have a question about a trade or need guidance using the platform? Fyers’ support team is there to help you via chat, email or phone. They can even help you develop and improve your trading strategies.

With competitive brokerage rates, an advanced trading platform, and personalized support, Fyers delivers an all-in-one solution for investors. Whether you’re new to the markets or an experienced trader, a Fyers account provides the tools and resources to help you achieve your financial goals. Open an account today and start taking advantage of these benefits. Your investments will thank you.

Frequently Asked Questions About Fyers Accounts

What are the different types of Fyers accounts?

Fyers offers three main types of accounts:

Trading account: For buying and selling stocks on exchanges like NSE and BSE. This is Fyers’ most popular account.

Demat account: To hold your shares in electronic format. You’ll need a demat account to trade stocks.

Margin funding account: Provides you leverage to trade with borrowed funds from Fyers. The margin amount depends on the stocks you want to trade.

How do I open a Fyers account?

Opening an account with Fyers is simple and can be done fully online:

Go to Fyers.in and click “Open Account.”

Provide some personal details like your PAN card number, bank details, email, and phone number.

Upload scanned copies of your PAN card and bank statements as proof of identity and address.

Fund your account through netbanking, UPI, or by depositing a cheque. The minimum balance to start trading is Rs. 20,000.

Your account will be opened within 2 business days. You can then download the Fyers trading platform and fund your account to start trading.

What are the brokerage and other charges?

Fyers has a flat brokerage charge of Rs. 20 per trade for cash delivery and 0.01% for margin funded stocks. They don’t charge any additional fees for account opening, maintenance, or software. You’ll only pay charges like GST, STT, stamp duty, and exchange transaction charges which are mandatory for all brokers.

Fyers also offers a premium plan with lower brokerage and additional benefits for high volume traders. The brokerage and fees are very competitive overall compared to other major stockbrokers in India.

How do I contact Fyers customer service?

You can contact Fyers customer support in several ways:

Call them on their toll-free number 1800-309-4422

Email them at support@fyers.in

Chat with their support team on the Fyers website and trading platform

Visit their support page at fyers.in/support for helpful resources and FAQs

Submit feedback or complaints on the SEBI SCORES portal

The Fyers support team is available Monday to Friday 9:30 am to 6 pm to help you with any questions about your account, trading platform, brokerage plans or other services.

Also Read:- How Early To Arrive For International Flight

So there you have it – the lowdown on Fyers and their offerings. From account types to platforms, research tools, and pricing, you’re now up to speed on everything this popular Indian stockbroker provides. While choice overload may seem daunting at first, just remember to focus on your own investing needs and style. Opt for an account tier that fits your activity level and budget. Test drive their slick web and mobile platforms to find what clicks with you. And leverage all those handy research goodies to make informed trading decisions. Who knows, Fyers could be your ticket to investing success in the Indian markets. But only you can take the first step and open that account.